Is Allstate Stock Underperforming the Nasdaq?

/Allstate%20Corp%20logo%20sign%20-by%20360b%20via%20Shutterstock.jpg)

With a market cap of $52.7 billion, The Allstate Corporation (ALL) is one of the largest publicly held personal lines insurers in the United States. Operating through five business segments, the company offers a wide range of property, casualty, life, health, and protection products to individuals, households, and employers across the U.S. and Canada.

Companies valued at $10 billion or more are generally classified as “large-cap” stocks, and Allstate fits this criterion perfectly. Allstate delivers its services through exclusive and independent agents, contact centers, and digital platforms, while also providing innovative protection plans and data-driven solutions.

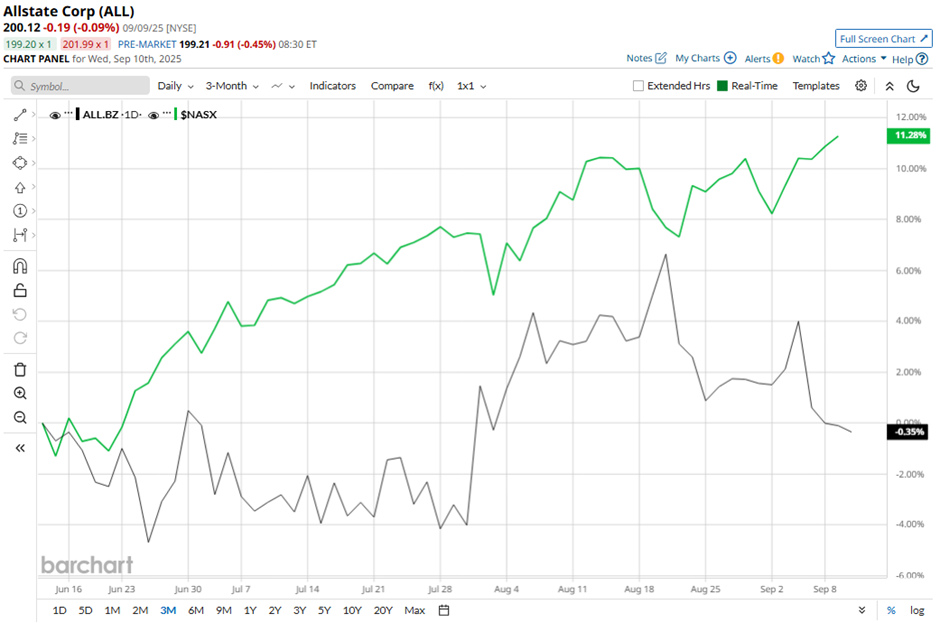

Despite this, shares of the Northbrook, Illinois-based company have declined 6.8% from its 52-week high of $214.76. ALL stock has risen 1.6% over the past three months, underperforming the Nasdaq Composite’s ($NASX) 11.7% increase over the same time frame.

In the longer term, ALL stock is up 3.6% on a YTD basis, lagging behind NASX’s 13.3% gain. Moreover, shares of the insurer have gained nearly 8% over the past 52 weeks, compared to NASX’s 29.6% return over the same time frame.

Despite a few fluctuations, the stock has been trading mostly above its 200-day moving average since last year.

Allstate shares rose 5.7% following its Q2 2025 results on Jul. 30 as the insurer posted adjusted EPS of $5.94, far surpassing analyst expectations. The strong performance was driven by a sharp turnaround in its property-liability segment, where underwriting income jumped to $1.28 billion from a loss a year earlier, and the underlying combined ratio improved significantly to 79.5%. Additionally, higher net investment income of $754 million reinforced investor confidence.

However, rival The Hartford Insurance Group, Inc. (HIG) has outpaced ALL stock. Shares of Hartford Insurance Group have returned 19.6% on a YTD basis and 11.9% over the past 52 weeks.

Despite the stock’s underperformance relative to the Nasdaq, analysts remain moderately optimistic on Allstate. ALL stock has a consensus rating of “Moderate Buy” from 23 analysts in coverage, and the mean price target of $231.79 is a premium of 15.8% to current levels.

On the date of publication, Sohini Mondal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.