Have Cattle Hit a Tipping Point?

Both live and feeder cattle futures face expanded daily trading limits Wednesday after feeders closed limit down across the board Tuesday.

While a case could be made for bearish technical signals, we've seen this before in both cattle markets while trends eventually continued up.

The bottom line is our reads on real market fundamental s have not changed, at least not yet, meaning both markets could stay well supported.

The bloodbath in the barn, also known as the Livestock sector, Tuesday afternoon brought to mind the well-known question from Hamlet’s famous soliloquy. But rather than, “To be (2B) or not to be (2B)…”, to me the query was, “Foray (4A) or not foray (4A), that is the question…”, referencing Newsom’s Market Rule 4A: A market that can’t go down won’t go down. Why? October live cattle (LEV25) closed $5.625 (2.4%) lower while December (LEZ25) finished with a loss of $6.40 (2.7%). Further out, the April issue lost as much as $7.15 over the course of the session, a few ticks away from yesterday’s daily limit of $7.25 (more on this in a bit). But that’s just the beginning as feeder cattle contracts closed down the daily limit of $9.25 from the nearby September (GFU25) through at least the August 2026 issue.

The obvious question is if the cattle markets, all the facets of both live and feeders, have reached a tipping point[i]. As I’ve been saying for quite some time, the markets, both live and feeder cattle, are due for a volatile change in trend similar to what we’ve seen in so many other markets over the years (e.g. corn at the end of May 2022, most markets in the Softs sector, etc.). However, before we get too bearish we need to keep in mind both cattle markets have done this before, only for both to eventually go higher. Why? Because as my friend in the cattle industry pointed out yesterday, there was commercial buying indicated by live cattle futures spreads. Fundamentally, both markets remain bullish, and as my Market Rule #6 says: Fundamentals win in the end.

That being said, I want to remind everyone both live and feeder cattle futures have expanded daily limits Wednesday due to the limit down close by feeders Tuesday. The new limits are $10.75 in live cattle and $13.75 in feeder futures. Historically, when a market moves into an expanded daily limit situation it tends to see muted action. However, most markets have an overnight session that acts as a pressure release valve, allowing for any pool of unfilled orders to move through the market rather than continuing to build ahead of the next day’s open. Of all the numbers I had on my quote screen at Tuesday’s close, the columns I forgot to add were the number of bids and asks in cattle, a way of monitoring the pool of unfilled orders in the markets.

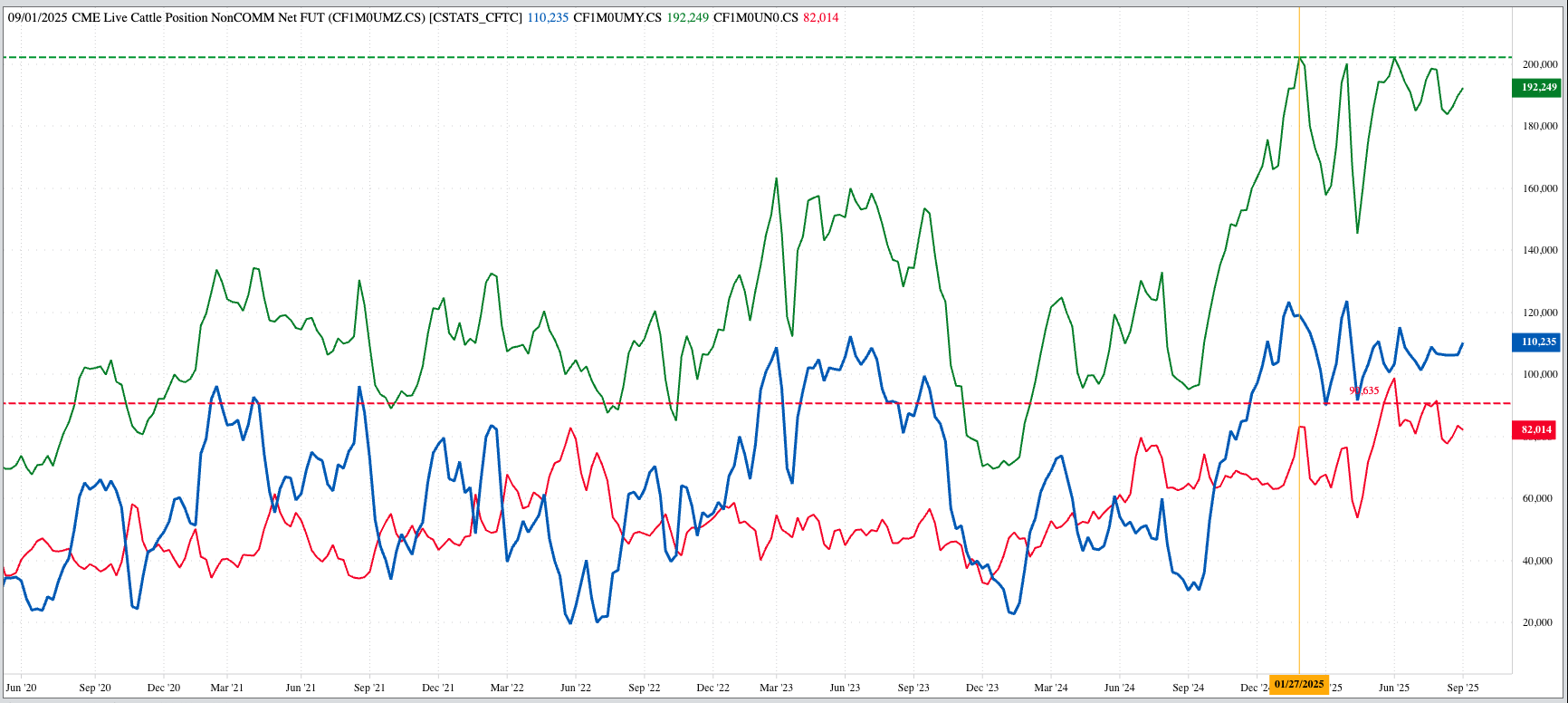

From a fundamental point of view, US boxed beef markets were mixed yesterday afternoon with choice down only $2.02 while select reportedly added $1.62. Let’s see what happens with cash indexes as we make our way through the rest of the week. Lastly, today is the first day of the new positioning week for Watson meaning it is entirely possible given Tuesday’s commercial support the noncommercial side is ready to buy again.

After Tuesday’s bloodbath in the cattle markets, it would be easy to post a number of charts looking at live cattle, feeder cattle, or both from a technical point of view. The problem is we’ve seen what looks to be bearish technical reversals before. Given this, let’s talk about fundamentals., and no, I do not mean next week’s September 1 Cattle on Feed numbers.

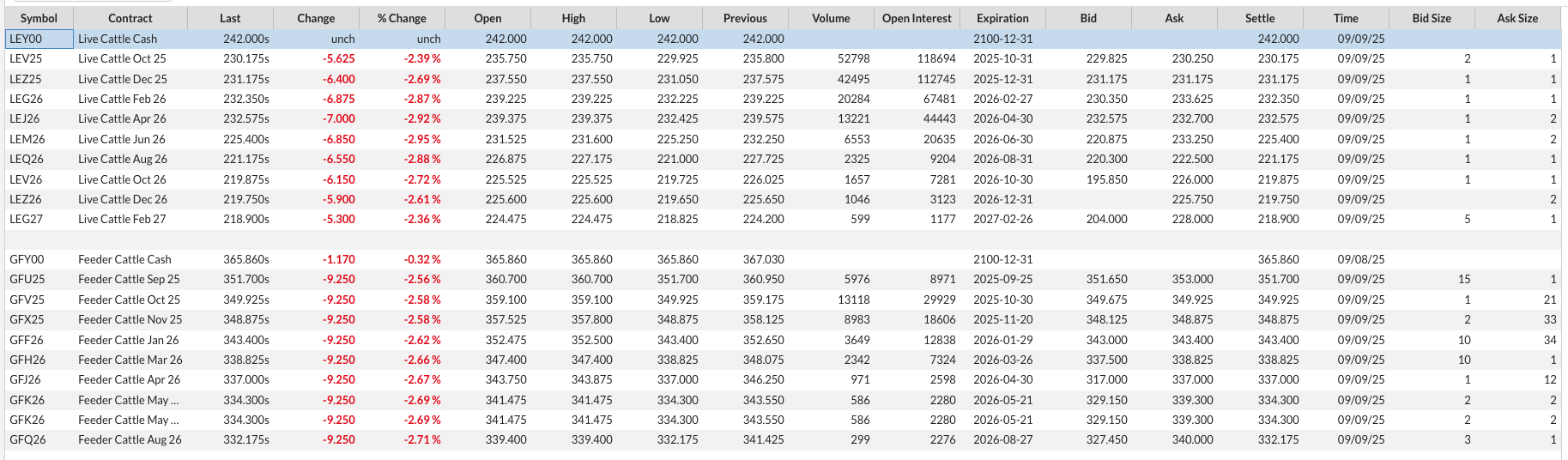

The quote screen from Tuesday’s close shows some interesting activity in live cattle.

- October closed $5.625 lower

- but gained $0.775 on December

- All as the September round of the Goldman Roll got under way, running through Friday

- December closed $6.40 lower

- but gained $0.475 on February

- February (LEG26) closed $6.875 lower

- but gained $0.125 on April

- The first three futures spreads all showed commercial support (nearby contract gaining on deferred)

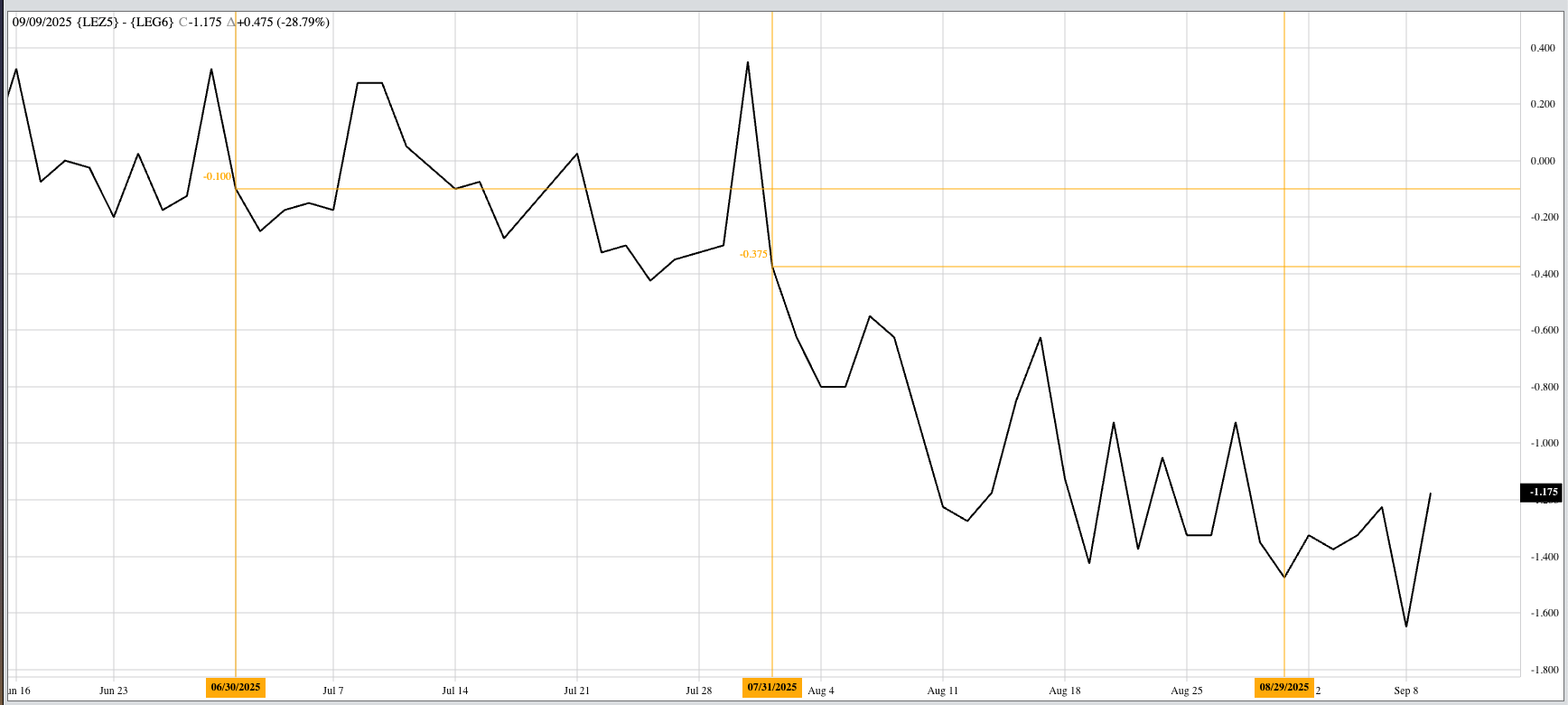

As for the December-February futures spread itself:

- Tuesday’s close was (-$1.175)

- as compared to last Friday’s settlement at (-$1.225)

- and the previous 5-year high weekly close for this week of (-$0.70)

In other words, our read on intermediate-term real supply and demand remains bullish.

[i] From Malcolm Gladwell’s book of the same name. The idea is the critical point, or “boiling point” at which “an idea, product, or trend spreads rapidly…”. In market terms, my interpretation is everything bullish that can be factored in has been factored in, leading to a volatile reversal in trend due to a change in noncommercial activity (Newton’s First Law of Motion applied to markets).

On the date of publication, Darin Newsom did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.