Is Estée Lauder Stock Underperforming the S&P 500?

With a market cap of $31.9 billion, The Estée Lauder Companies Inc. (EL) is a global leader in the beauty industry. The company manufactures, markets, and sells a wide range of skin care, makeup, fragrance, and hair care products under prestigious brands such as Estée Lauder, Clinique, La Mer, M·A·C, Jo Malone London, and TOM FORD Beauty.

Companies valued at $10 billion or more are generally classified as “large-cap” stocks, and Estée Lauder fits this criterion perfectly. Its products are distributed worldwide through department stores, specialty retailers, online platforms, salons, spas, and direct-to-consumer channels.

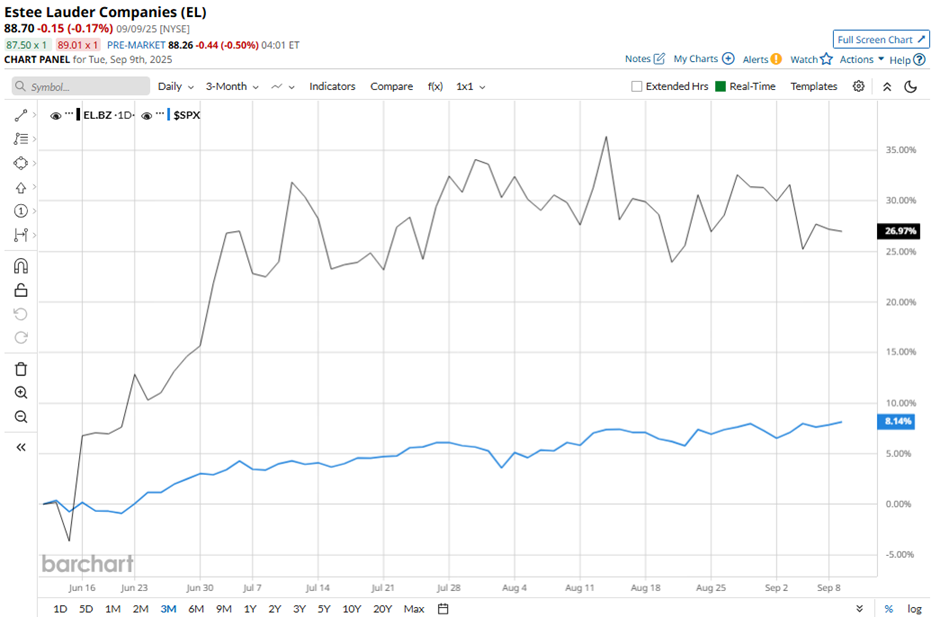

Shares of the New York-based company have fallen 14.3% from its 52-week high of $103.44. Estée Lauder’s shares have increased 28.6% over the past three months, outperforming the broader S&P 500 Index’s ($SPX) 8.4% gain over the same time frame.

In the longer term, EL stock is up 18.3% on a YTD basis, outpacing SPX’s 10.7% return. However, shares of the beauty products company have risen 2.1% over the past 52 weeks, lagging behind the 19% surge of the SPX over the same time frame.

EL stock has been trading above its 50-day moving averages since early May. In addition, the stock has remained above its 200-day moving average since mid-June.

Despite reporting better-than-expected Q4 2025 adjusted EPS of $0.09 and revenue of $3.4 billion, Estée Lauder’s shares fell 3.7% on Aug. 20 because its full-year adjusted EPS forecast of $1.90 - $2.10 came in below analysts’ expectations. Management warned that a $100 million tariff-related hit, coupled with elevated costs from global trade pressures, would weigh on margins. Additionally, weakness in key markets like the U.S., China, and Europe, along with muted travel retail sales and ongoing restructuring charges, fueled investor concerns.

Nevertheless, rival Church & Dwight Co., Inc. (CHD) has underperformed EL stock. CHD stock has declined 9.4% on a YTD basis and 10.1% over the past 52 weeks.

Despite the stock’s underperformance relative to the SPX over the past year, analysts remain moderately optimistic on Estée Lauder. EL stock has a consensus rating of “Moderate Buy” from the 25 analysts in coverage, and the mean price target of $91.43 is a premium of 3.1% to current levels.

On the date of publication, Sohini Mondal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.